The December 2020 stimulus and COVID relief bill has two major features that impact student loan borrowers.

First, there is no further extension of the payment and interest pause for federal student loans set to expire January 31, 2021. Second, the bill extends for five years the ability of employers to make tax-free student loan repayment contributions for employees in amounts up to $5,250 a year.

However, the Georgia Senate election results surprised many by delivering the Senate chamber to Democrats. That increases the chances significantly for a 2021 student loan stimulus that extends the payment and interest freeze as long as September 30, 2021.

That said, unless President Biden extends this payment and interest freeze on or shortly after January 20, 2021, your student loan payments will start again after January 31, 2021.

Secretary of Education Betsy DeVos already extended the 0% student loan interest and $0 monthly payment policy until the end of January when it was supposed to expire December 31, 2020. She did this to give Congress more time to deliberate.

But then Congress shocked the student loan world by not extending this policy. Presumably, Congressional Democrats expected President Biden to use executive action to further extend the freeze. However, now Democrats will have a legislative avenue to pursue a third student loan stimulus, after the CARES Act in March and December 2020 stimulus.

We will see what Congress will do now that Democrats control both chambers.

What is in the December 2020 stimulus bill for student loan borrowers?

Here’s what’s included in the December stimulus bill that might benefit current or future student loan borrowers:

- Slight increase in maximum Pell Grant

- Incarcerated persons can now receive Pell Grants

- The FAFSA will be dramatically simplified to allow more students to apply

- Over $1 billion in institutional debt of HBCUs will be forgiven

- Students may now continue to receive a subsidy on certain subsidized Stafford loans for undergrad for a longer period of time

- Employers may contribute up to $5,250 each towards their employees’ student loans, with this program set to expire in five years now instead of at the end of this year.

Here’s what’s not included in the stimulus bill.

- Changing income driven repayment programs

- Eliminating taxes on student loan forgiveness

- Capping the amount students can borrow for undergraduate or graduate degrees

- Extending the pause on student loan repayment and interest

Employer student loan repayment assistance tax deduction in this stimulus bill is the biggest change to student loans in 10 years

By far the biggest impact to student loans in this bill will be employer student loan repayment assistance. Lobbyists for large employers have wanted to make this a tax deductible benefit for years so they could incentivize younger workers to stay with their companies.

By extending this benefit for five years instead of one, Congress is essentially communicating to large employers that this benefit will be permanent.

I expect an explosion of employer student loan assistance programs as a result.

The other huge change is the simplification of the FAFSA, though that is not a change to student loan repayment programs. It’s simply going to help lower income borrowers complete the form more easily and be eligible for more aid.

Could President Biden extend the payment and interest suspension?

We anticipate that President Biden will extend the payment and interest freeze past January 31, 2021. He could issue an executive order to extend the payment and interest freeze on his own given Secretary DeVos and President Trump have already taken this action.

Presumably, that freeze would expire sometime between the late spring and early summer given Congress is uninterested in continuing the 0% interest $0 monthly payments policy it enacted in March of 2020.

Student loan servicers would be required to send out notifications of payments resuming in early January, and borrowers would be days away from payments beginning again regardless of what executive orders might come from a new administration.

So regardless, without Congressional action on student loan relief in the December 2020 stimulus bill, borrowers will get conflicted messaging in early 2021 on their student loan repayment.

Prior attempts at extending student loan relief after the CARES Act

The HEROES Act supported by the Democratic House called for suspending interest and payments on federal student loans until September 30, 2021. The $3.4 trillion price tag of the overall bill caused Republicans to strongly oppose it.

The HEALS Act supported by the Republican Senate called for eliminating all student loan repayment plans besides REPAYE and the Standard 10 year, along with resuming payments and interest September 30, 2020. That did not happen either.

President Trump announced in a press conference on August 7, 2020, that student loan payments and interest “would be suspended until December 31, 2020, with a likely extension after that.”

Then in early December, Sec. DeVos extended the payment and interest freeze further until January 31, 2021, when borrowers currently need to be prepared to begin repayment again.

What is the student loan relief present in the CARES Act?

The Senate and House passed the $2.2 trillion CARES Act stimulus plan on Friday, March 27, 2020. That afternoon, President Trump signed the bill into law.

While the main purpose of the stimulus was to keep the economy running, the bill also provided enormous relief to borrowers with federal student loans.

This national student loan forbearance happened automatically. Most borrowers will not need to respond or make changes from what they are currently doing.

You have the right to request a refund for any payments made between March 13 and January 31, 2021. Zero-dollar monthly payments still count during this time for Income-Driven-Repayment (IDR) and Public Service Loan Forgiveness (PSLF).

Here were the most important provisions of the coronavirus student loan relief bill:

- Suspension of all payments for six months through September 30, 2020 (extended to January 31, 2021, via executive action)

- Takes effect automatically without any effort on the part of a borrower

- The suspended payments count towards loan forgiveness programs, including PSLF and IDR forgiveness (PAYE, REPAYE, IBR)

- No interest will accrue until September 30, 2020 (extended to January 31, 2021)

- Employers who contribute to their employees’ student loans receive a tax break up to $5,250, although that measure must be renewed in 2021 to be permanent

- Borrowers in default will have their months of suspended payments count towards the nine months needed for loan rehabilitation

- No collection, wage garnishment, or seizure of tax refunds will happen (backdated to March 13, 2020)

Unfortunately, this bill did absolutely nothing for borrowers with private student loans, FFEL loans held by private institutions or the Department of Health student loans.

The stimulus plan is amazing if you have federal student loans

Some versions of the coronavirus rescue plan included anywhere from $10,000 to $50,000 in student loan cancellation in addition to Congress making payments for everyone.

While that did not come to pass, the CARES Act bill and subsequent executive orders have been extraordinarily generous for borrowers with federal student loans.

There were already protections in place to reduce your income-based payment if you lost your job.

However, millions of people were about to lose their jobs at the same time, and this is clearly not what loan servicers are built for.

Borrowers needed federal help because many don’t know how to recalculate their payment

Servicers like FedLoan Servicing shut down many of their operations during the coronavirus pandemic.

So, even if borrowers knew they could recalculate their income-based payment to a number as low as $0 a month if they lost their job, they couldn’t get someone on the phone to do that in many cases.

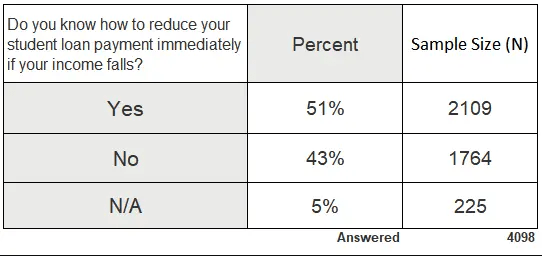

Also, our survey of 4,100 readers on March 18, 2020, suggested that at least 43% of borrowers did not even understand how to pause their federal student loan payments if their income falls. See the table below.

Our readers tend to be graduate degree-holding professionals who are more informed than average on student loan rules.

Hence, the true number of borrowers who know how to recalculate their payment is likely much lower.

When I saw this data, I knew we needed broader action than the Trump student loan interest freeze with a 60-day forbearance.

This stimulus bill took dramatic action and allows borrowers to count all suspended payments for the next six months towards any forgiveness problem they would have been eligible for.

So borrowers continue to accrue credit towards PSLF, IDR, and other forgiveness programs. In the case of PSLF, you would need to maintain a full-time job at a not for profit or government employer but these $0 a month payments would count.

Remember there are no employment conditions for 20 year PAYE and 25-year REPAYE forgiveness. So suspended payments count for that type of forgiveness too.

In other words, if you’re a borrower with Federal Direct Student Loans, there is no reason not to get excited about the national student loan forbearance until it ends.

At least 6 million federal student loan borrowers got left behind

Only loans held by the Department of Education qualify for this interest and payment freeze, thanks to the stimulus plan language.

That means that loans made under the Federal Family Education Loan Program (FFELP) do not qualify if they are held by a commercial lender.

The government stopped issuing FFELP loans in 2010, so anyone who graduated or went to school before that time likely has this kind of student loan.

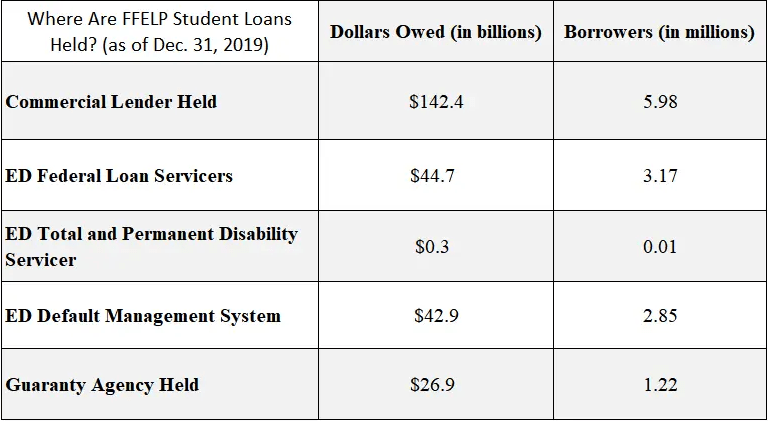

Here’s the December 2019 breakdown of FFELP student loans by who owns them to show the approximate breakdown of the problem at the time interest and payments were frozen:

A minimum of 6 million student loan borrowers with federal loans “owned by a commercial lender” received no help with their student loans at all, despite having used a federal borrowing program.

Borrowers with Department of Health Student Loans do not get relief either

The Department of Health actually has a large student loan program. Dentists, physicians and nurses often take out Health Professions Student Loans (HPSL) or Loans for Disadvantaged Students (LDS).

These loans carry a 5% interest rate and usually show up under the loan servicer Heartland ECSI if you have them.

You can actually consolidate these loans into a Direct Consolidation Loan to receive forgiveness.

However, most borrowers assume Health Professions student loans are private and thus are ineligible for forgiveness programs.

This is an extremely common five-figure mistake our clients make when managing their own student loans.

Of course, Congress left out the Department of Health student loans from any relief, affecting many thousands of healthcare practitioners.

If you have this kind of loan, you would generally need to consolidate to receive a subsidy.

How to get the student loan interest and payments freeze on loans that don’t qualify

Borrowers with older and less common types of federal student loans can consolidate them into a Direct Consolidation loan to receive the payment and interest freeze.

However, these loans could lose all credit towards Income-Based Repayment forgiveness.

When you consolidate a student loan, you lose all credit towards the date that loan gets forgiven.

That’s very important. Don’t just consolidate every FFEL loan without knowing if you’re hurting your chances of forgiveness first.

If that concern does not apply to you, then consolidate your non-Direct loans by logging into the Federal Student Aid website and clicking on the “consolidate my loans” section.

Help for borrowers in default

Millions of student loan borrowers are in default on their student loans.

One way to exit default is to make nine months of consecutive payments

Unfortunately, borrowers often miss a payment and cannot get their loans rehabilitated, leading to wage garnishment and seizure of tax refunds.

Importantly, if you’re trying to rehabilitate your federal student loans, with the stimulus plan you can now count the months of suspended payments towards the nine months needed to exit default.

That’s big news as most borrowers will be able to rehabilitate their loans right away when the forbearance ends in January 31, 2021, or after.

When you rehabilitate your student loan, you remove this negative event from your credit score and get enrolled in an income-driven plan so that the loans are affordable for the future.

The other way to manage default is to consolidate your student loans.

However, that does not remove the default from your credit score.

Tax refund seizure, collections, and wage garnishment is on hold

In addition to helping borrowers get out of default for the future, this coronavirus stimulus bill pauses collections efforts on federal student loans.

It also stops collections, wage garnishment, and seizure of tax refunds retroactive to March 13, 2020.

That’s also big news for borrowers struggling the most.

If you had your tax refund seized on or after March 13, 2020, you need to make sure your address is current in the Department of Education system. Call 800-621-3115 to make sure they mail your check to the right address.

Employers can now deduct student loan payments made for employees’ student debt

According to CNBC, the student loan stimulus plan gives employers a tax deduction for paying employees’ student loans. The measure is now in effect through at least 2025.

Corporate lobbyists have worked to pass tax-free employer student loan assistance for years.

It will help some of our readers, but I don’t trust a policy that company lobbyists want that badly.

I’ve gone on the record that employer student loan assistance does not help as much as you think and can actually hurt you in some cases.

It’s the same thing as giving a tax break for employer-provided health insurance. It makes the workforce less mobile and more tied to their job, which is in the interest of the employer more than the employee.

Importantly, student loan contributions replace money that might have gone towards higher wages, which continue after you have $0 student loans.

Even some non-profit hospitals require that payments they make for student loans be applied directly to loans held by the loan servicer, which is stupid in the case of a borrower working towards PSLF.

At least now you can apply lump sum payments to PSLF IDR monthly payments, which was not always the case.

Full disclosure: this website receives a large portion of its revenue from readers who decide to refinance their student loans to a lower interest rate.

Federal student loan borrowers receive an interest freeze. Private student loan borrowers receive a slap in the face.

By setting federal student loan interest rates at 0%, you effectively kill any student loan refinancing for the next six months (except for refinancing loans that are already private).

Our company has cash reserves, and people will refinance again in the future when federal student loan interest is no longer at 0%. Plus, borrowers needed student loan relief during this crisis, and I’m glad some of our readers are getting that help.

I’m incensed though that huge numbers of borrowers who refinanced their student loans with private lenders will get absolutely no help from Congress.

They seem to be bailing out everyone else.

What message do you send to borrowers who wanted to responsibly pay down their student debt when you rescue all federal student loan borrowers but leave private student loan borrowers out of any relief package?

A critic might ask what Congress could have done?

It’s simple: reimburse private companies for the interest just as they did for a host of other industries.

Unfortunately, borrowers with private or refinanced student loans will join many with FFEL and Deptartment of Health loans in receiving no help.

Make this short term student loan relief lead to a long term plan

Suspending payments and interest for many months is a great step for federal student loan borrowers.

Obviously, we wish more borrowers had been included in the relief package.

Unfortunately, student loans will still be there after the payment and interest freeze is over.